Gravitational Wave Resonator Manufacturing: 2025's Billion-Dollar Leap & the 5-Year Tech Race

Table of Contents

- Executive Summary: 2025 and Beyond

- Market Size & Forecast: 2025–2030 Projections

- Key Players & Strategic Alliances

- Breakthrough Technologies and Material Innovations

- Supply Chain Resilience & Global Manufacturing Hubs

- Cost Drivers and Profitability Trends

- Regulatory Landscape & Standards (ieee.org, asme.org)

- Emerging Applications: Quantum Computing, Astrophysics, and Defense

- Competitive Analysis: New Entrants vs. Incumbents

- Future Outlook: Investment Hotspots and Disruption Scenarios

- Sources & References

Executive Summary: 2025 and Beyond

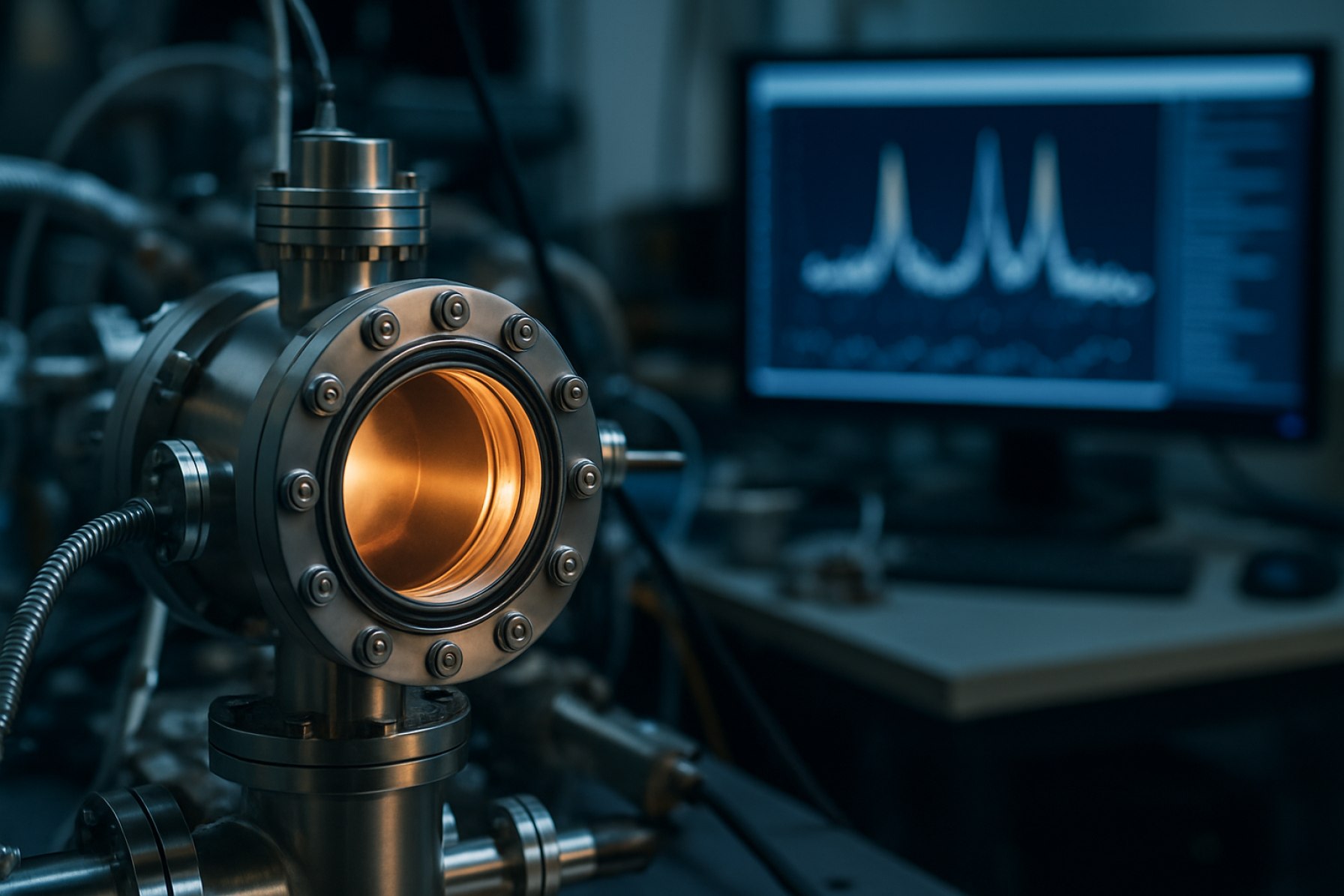

The field of gravitational wave resonator manufacturing is poised for significant development in 2025 and the coming years, driven by escalating global investments in gravitational wave (GW) observatories and next-generation detector technologies. Gravitational wave resonators—core components in interferometric detectors—are essential for amplifying and capturing the minute spacetime distortions caused by cosmic events. The surge in demand is closely tied to the expansion of projects such as the Laser Interferometer Gravitational-Wave Observatory (LIGO), Virgo, and KAGRA, as well as ambitious next-generation facilities like the Einstein Telescope and Cosmic Explorer.

By 2025, manufacturers are focusing on ultra-high precision fabrication of optical and mechanical resonators, using materials like fused silica, sapphire, and crystalline silicon. Companies such as Gooch & Housego and Thorlabs, Inc. are leading suppliers of advanced optics and components essential for resonator construction, supporting upgrades to existing detectors and prototyping for new facilities. These firms are investing in cleanroom-based manufacturing, ion-beam polishing, and advanced metrology to achieve the sub-nanometer surface tolerances required for gravitational wave applications.

A notable trend in 2025 is the collaboration between research institutions and industry to co-develop bespoke resonators. For example, the LIGO Laboratory and Virgo Collaboration are working closely with suppliers to refine mirror coatings and suspension systems that minimize thermal noise and maximize sensitivity. The adoption of crystalline coatings, pioneered by groups at Caltech and implemented by partners in industry, is expected to be a cornerstone of next-generation resonator manufacturing.

Looking beyond 2025, the commissioning of the Einstein Telescope in Europe and Cosmic Explorer in the US will require scaling up production and further innovation in resonator materials, size, and thermal management. The Einstein Telescope Collaboration has outlined requirements for large-scale, cryogenic-compatible resonators, spurring manufacturers to invest in new crystal growth, annealing, and bonding processes. Suppliers are also exploring automation and precision robotics to meet the anticipated volume and consistency demands.

In summary, 2025 marks a transition from bespoke, small-batch production toward scalable, industry-grade manufacturing of gravitational wave resonators. The outlook is shaped by increasing institutional funding, collaborative R&D, and a push for higher performance components—setting the stage for breakthroughs in gravitational wave detection technology well into the next decade.

Market Size & Forecast: 2025–2030 Projections

The market for gravitational wave resonator manufacturing is poised for notable growth between 2025 and 2030, buoyed by increasing global investment in multi-messenger astronomy and next-generation gravitational wave observatories. The sector—historically niche, centered around a handful of highly specialized foundries and ultra-precision engineering firms—has recently drawn broader interest as the demand for more sensitive, robust, and scalable resonators accelerates.

Leading manufacturers such as Thorlabs, Inc. and Newport Corporation have reported ramping up development and customization services for ultra-low-loss mirrors, crystalline coatings, and advanced opto-mechanical components, which are integral to gravitational wave resonator assembly. Furthermore, institutions like the LIGO Laboratory and Virgo Collaboration continue to collaborate directly with specialized suppliers to refine key subsystems and explore novel resonator materials and architectures aimed at reducing thermal and quantum noise in future detectors.

Forecasts suggest that the market value of gravitational wave resonator manufacturing, while still measured in tens of millions USD globally per year, could witness a compound annual growth rate (CAGR) exceeding 12% through 2030, driven by the following sectoral trends:

- Expansion and upgrades of international observatories, such as the planned Einstein Telescope in Europe and the US-based LIGO A+ and Cosmic Explorer programs, all of which will demand large volumes of next-generation resonators and related components.

- Ongoing R&D investment in cryogenic and quantum-enhanced resonator designs by research institutions and suppliers, in pursuit of lower detection thresholds and broader frequency sensitivity.

- Emergence of new players in the high-precision optics and materials sector, especially in the Asia-Pacific region, where companies such as Shinkosha Co., Ltd. are increasing their footprint in advanced coating technologies suitable for resonator applications.

Looking ahead to 2025–2030, the supply chain is expected to diversify, with more regional manufacturing hubs and vertically integrated providers entering the market. This will support both cost control and innovation in resonator design, as observatory consortia and funding agencies increasingly prioritize performance, sustainability, and supply resilience. With several flagship projects set to break ground within this timeframe, the gravitational wave resonator manufacturing sector is positioned for its most dynamic period of expansion to date.

Key Players & Strategic Alliances

The field of gravitational wave resonator manufacturing is entering a pivotal phase in 2025, with several key organizations advancing both the underlying technologies and the collaborative frameworks necessary to sustain progress. At the forefront are established research institutions and specialized manufacturers that have developed expertise in ultra-high-precision optics, cryogenic systems, and resonator fabrication.

A principal player in this domain is California Institute of Technology (LIGO), which, in partnership with the Massachusetts Institute of Technology (MIT), operates the Laser Interferometer Gravitational-Wave Observatory. LIGO’s ongoing upgrades for its A+ and proposed Cosmic Explorer projects are driving demand for next-generation resonators with unprecedented sensitivity and low thermal noise characteristics. This has led LIGO to initiate strategic collaborations with precision optics manufacturers such as Zygo Corporation, which supplies high-performance super-polished mirrors and substrates, and Herriot Precision Components, known for custom optical components for scientific instrumentation.

In Europe, the European Gravitational Observatory (EGO) is leading the Virgo collaboration, which is also pursuing significant upgrades. EGO has established ties with advanced materials suppliers and vacuum technology firms including Leybold and Edwards Vacuum for the fabrication and maintenance of ultra-high-vacuum chambers critical for resonator performance.

Japan’s KAGRA (Institute for Cosmic Ray Research, University of Tokyo) remains a global leader in cryogenic gravitational wave resonators, leveraging alliances with material science leaders such as Shin-Etsu Chemical for high-purity silicon substrates and Nippon Steel Corporation for specialty steel components used in vibration isolation systems.

Strategic alliances have also arisen in anticipation of third-generation observatories. The Einstein Telescope (ET) consortium, coordinated by ET Collaboration, is fostering pan-European industrial partnerships to develop scalable manufacturing processes for large-scale resonators and mirror suspensions, engaging multiple institutes and high-tech suppliers in the region.

Looking ahead, these alliances are expected to intensify, as key players seek to leverage shared expertise in precision engineering, advanced materials, and quantum measurement. The next few years are likely to see new joint ventures and public-private partnerships, as manufacturing requirements grow more complex with the advent of larger, more sensitive gravitational wave observatories.

Breakthrough Technologies and Material Innovations

The manufacturing of gravitational wave resonators is entering a transformative phase in 2025, marked by significant technological advancements and material innovations. As the demand for higher sensitivity in gravitational wave detection increases, manufacturers are focusing on new materials and fabrication techniques that promise to redefine resonator performance.

A major event in the sector is the refinement and deployment of crystalline silicon resonators, which offer ultra-low mechanical loss at cryogenic temperatures. This material innovation, spearheaded by collaborative projects at institutions like LIGO, has led to the manufacturing of test masses with unprecedented purity and homogeneity. These resonators are produced using advanced float-zone silicon growth methods, resulting in reduced thermal noise and greater detection precision.

Manufacturing processes are also benefitting from precision laser machining and ion-beam figuring, enabling the production of optical surfaces with atomic-level smoothness. Companies such as Gooch & Housego are leveraging these techniques to supply optics and substrates tailored to the exacting demands of next-generation detectors. In 2025, these fabrication methods are being scaled up to accommodate the larger, heavier mirrors needed for future observatories, such as the planned Einstein Telescope in Europe.

Coating technology remains a critical focus, as the mechanical losses in mirror coatings currently limit detector sensitivity. Innovative approaches being evaluated include crystalline coatings, such as gallium arsenide/aluminum gallium arsenide multilayers, which are being developed in partnership with organizations like Laser Zentrum Hannover. These coatings significantly reduce thermal noise, a key barrier to further sensitivity improvements.

In parallel, additive manufacturing (3D printing) is being adopted for rapid prototyping of suspension elements and resonator components. Thorlabs and similar suppliers are integrating advanced additive manufacturing processes, allowing for the creation of complex geometries and bespoke designs that traditional machining cannot achieve. This flexibility accelerates iteration cycles and supports the customization of resonator systems for specific research needs.

Looking ahead, the outlook for gravitational wave resonator manufacturing is characterized by increased industrial collaboration, automation, and integration of artificial intelligence for quality control. The sector is poised for rapid advances as facilities like Advanced LIGO and the Einstein Telescope push for ever-lower noise floors and broader detection bandwidths. Manufacturers are expected to continue pushing the boundaries of material science and process engineering, ensuring that gravitational wave astronomy remains at the technological cutting edge.

Supply Chain Resilience & Global Manufacturing Hubs

The supply chain for gravitational wave resonator manufacturing is characterized by its reliance on ultra-high-precision components, advanced materials, and specialized fabrication techniques. As of 2025, the field is dominated by a select group of global manufacturing hubs and research institutions with the capability to deliver the necessary quality and scale for next-generation gravitational wave observatories.

Key suppliers and manufacturers primarily cluster in the United States, Europe, and Japan. Facilities such as the LIGO Laboratory in the US and European Gravitational Observatory (EGO) in Italy serve both as research centers and as focal points for procurement and component qualification. Japan’s KAGRA project also acts as a regional hub, leveraging local expertise in cryogenics and precision engineering.

The COVID-19 pandemic exposed vulnerabilities in the global supply of ultra-pure fused silica, sapphire, and other specialty materials critical for resonator mirrors and suspensions. In response, manufacturers and observatories have intensified efforts to dual-source raw materials and expand regional manufacturing partnerships. For instance, Heraeus in Germany and Corning Incorporated in the US remain among the few producers of optical-grade fused silica at the required purity and scale, prompting ongoing capacity expansions and technology upgrades.

Precision mirror fabrication—a linchpin of resonator performance—relies on ultra-polishing and ion-beam figuring, processes mastered by a handful of specialist firms. Zygo Corporation and Lam Plan continue to invest in metrology and automation to meet the increasing demands from both ground-based and planned space-based observatories.

Looking ahead, supply chain resilience remains a priority. Initiatives such as the Einstein Telescope’s regional procurement strategy and LIGO’s efforts to localize more component manufacturing are designed to mitigate geopolitical and logistical risks. There is also a notable trend toward collaborative R&D between industry and academia, with programs like the Advanced LIGO project fostering joint innovation in coating materials and vibration isolation systems.

Overall, the gravitational wave resonator manufacturing ecosystem is projected to become more diversified and robust through 2025 and beyond, driven by both the expansion of observatory networks and the imperative for greater supply chain security.

Cost Drivers and Profitability Trends

The manufacturing of gravitational wave resonators—a cornerstone technology for advanced astrophysics and precision measurement applications—continues to be shaped by several cost drivers and evolving profitability trends as of 2025 and looking into the near future. Key factors influencing costs include raw material sourcing, fabrication precision, quality control, and the integration of advanced quantum technologies.

One of the primary cost drivers remains the acquisition and ultra-high purity processing of materials such as fused silica and single-crystal silicon, which are essential for achieving the low mechanical loss and thermal noise requirements in resonators. For example, Heraeus is a leading supplier of high-purity fused silica, and fluctuations in silica prices have a direct impact on overall manufacturing costs. Additionally, the demand for silicon mirrors and substrates with atomic-scale smoothness continues to rise, pushing up both sourcing and inspection costs.

Manufacturing costs are also shaped by the need for advanced machining and polishing processes. Companies like Innovative Optics specialize in precision optical polishing and coating, which are critical for producing resonators with the required reflectivity and flatness. The move toward larger-scale interferometers and next-generation detectors, such as the Einstein Telescope and Cosmic Explorer, is increasing the demand for larger, more complex resonators, with correspondingly higher manufacturing and quality assurance costs.

Another significant factor is the integration of quantum technologies—such as squeezed light sources and cryogenic cooling—which requires additional engineering and cleanroom assembly, adding to overhead and labor costs. Thorlabs and Edmund Optics are expanding R&D and production capabilities to support quantum-enhanced resonator components, which is expected to gradually improve economies of scale but entails upfront capital expenditure.

Profitability trends in this sector are nuanced. While the initial outlay for resonator manufacturing remains high due to precision and materials requirements, the sector is witnessing incremental reductions in unit costs through automation, improved metrology, and better supply chain integration. As an example, Laseroptik reports increased throughput and reduced per-unit costs thanks to investments in automated coating and inspection systems.

Looking ahead, industry participants anticipate moderate margin improvements as collaborative procurement and shared R&D initiatives—such as those led by the Gravitational Wave Open Science Center—help standardize components and processes. Nevertheless, the outlook for the next few years is that profitability will remain closely tied to public and institutional funding cycles, with commercial applications still emerging and largely dependent on advances in quantum sensing and precision measurement markets.

Regulatory Landscape & Standards (ieee.org, asme.org)

The regulatory landscape and standards environment for gravitational wave resonator manufacturing is rapidly evolving as the field transitions from research-driven initiatives to scalable, precision engineering. As of 2025, oversight and standardization efforts are largely spearheaded by internationally recognized organizations such as the Institute of Electrical and Electronics Engineers (IEEE) and the American Society of Mechanical Engineers (ASME). These bodies are instrumental in developing frameworks that address both the safety and interoperability of resonator systems.

IEEE, through its Sensor and Instrumentation Standards Committee, has initiated working groups to define protocols for the electromagnetic and mechanical interfaces of ultra-sensitive detectors, such as those used in gravitational wave observatories. Recent IEEE workshops (2024–2025) have prioritized the standardization of signal processing electronics, noise reduction techniques, and calibration procedures essential for resonator performance and data integrity. Draft guidelines, expected to be published in 2025, aim to harmonize design and testing methods across manufacturing facilities, enhancing international collaboration and component exchange (IEEE Standards).

ASME, meanwhile, is addressing the mechanical aspects of resonator manufacturing, focusing on material purity, thermal stability, and vibration isolation—critical for the ultra-low-noise environments required in gravitational wave detection. The ASME V&V (Verification and Validation) subcommittees are actively developing standards for the modeling, simulation, and physical testing of resonator assemblies. In 2025, ASME’s “Materials and Structures for Precision Metrology” initiative is expected to release new guidelines governing the allowable tolerances and quality assurance protocols for the fused silica and single-crystal silicon components prevalent in these systems (ASME Codes & Standards).

- Manufacturers’ Compliance: Leading manufacturers are already aligning internal processes with these evolving standards. For instance, suppliers of ultra-high vacuum systems and cryogenic components are integrating traceability documentation and non-destructive evaluation protocols as outlined in draft IEEE and ASME standards.

- Outlook: Over the next few years, the formal adoption of these standards is anticipated to accelerate qualification cycles for new resonator designs, streamline international procurement, and support the deployment of next-generation gravitational wave detectors. Regulatory consistency is also expected to facilitate broader participation from precision manufacturing firms previously outside the scientific instrumentation sector.

As the gravitational wave resonator manufacturing sector matures, active engagement with the standards development process remains crucial. Both IEEE and ASME invite industry input to ensure that emerging regulations promote innovation while upholding the rigorous performance demands of this transformative technology.

Emerging Applications: Quantum Computing, Astrophysics, and Defense

The rapid evolution of gravitational wave resonator manufacturing is unlocking transformative applications in quantum computing, astrophysics, and defense, with 2025 poised to be a pivotal year. These resonators—ultra-sensitive mechanical or optomechanical devices—are now being engineered with unprecedented material precision and signal fidelity, responding to the stringent demands of next-generation quantum and astrophysical instrumentation.

In quantum computing, gravitational wave resonators are being harnessed as quantum sensors and memory elements, capitalizing on their isolation from environmental noise and high mechanical Q-factors. Researchers at National Institute of Standards and Technology (NIST) have reported the fabrication of resonators from crystalline silicon and sapphire, achieving ultra-low dissipation levels, which are critical for qubit coherence and error correction. Collaborations with leading quantum device manufacturers are underway, integrating these resonators into hybrid quantum systems to enhance entanglement distribution and quantum transduction.

Astrophysical observatories, such as those operated by LIGO Laboratory and European Gravitational Observatory (Virgo), are actively upgrading their gravitational wave detectors with resonators featuring advanced coatings and suspension systems. In 2025, procurement of novel single-crystal resonators and ultra-pure fused silica suspensions is expected to intensify, as facilities pursue greater sensitivity to probe cosmic events at lower frequencies. ESI Group is among the suppliers providing simulation and validation software for resonator design, ensuring robust performance under cryogenic conditions anticipated in next-generation observatories.

The defense sector is also investing in gravitational wave resonator manufacturing, recognizing their potential for secure quantum communication and navigation. Government labs and defense contractors are partnering with manufacturers to develop miniaturized, ruggedized resonators for deployment in spaceborne and terrestrial systems. Lockheed Martin and Northrop Grumman have publicly disclosed initiatives to integrate precision resonators into their quantum sensing platforms, aiming to enhance detection capabilities for both strategic communications and geophysical monitoring.

Looking ahead, the outlook for gravitational wave resonator manufacturing is marked by increasing cross-sector collaboration, automation in microfabrication, and adoption of novel materials such as diamond and silicon carbide. As the global ecosystem matures through 2025 and beyond, the synergy between scientific research and industrial manufacturing promises to accelerate the deployment of these resonators in quantum computers, astrophysical observatories, and advanced defense systems.

Competitive Analysis: New Entrants vs. Incumbents

The gravitational wave resonator manufacturing sector is experiencing significant evolution in 2025, driven by the entry of innovative startups and the strategic repositioning of established players. The market, historically characterized by a small number of technologically advanced incumbents, is seeing an infusion of new entrants leveraging breakthroughs in quantum materials, precision engineering, and cryogenic systems.

Among the incumbents, Thorlabs, Inc. and Gentec-EO have continued to dominate the supply of high-stability optical and mechanical components integral to resonator construction. These companies have responded to increased competition by expanding their portfolio of ultra-low-loss mirrors, vibration isolation platforms, and advanced photodetectors—all critical for gravitational wave detection. In 2024 and 2025, both have invested in automation for component fabrication and quality control, reducing production times and improving consistency at scale.

New entrants are disrupting the competitive landscape with modular, scalable resonator designs and novel materials. For instance, Spectra-Physics, traditionally known for laser systems, has begun supplying specialized coatings and substrates for next-generation resonators, collaborating with research laboratories to tailor their products for enhanced quantum noise reduction. In parallel, startups such as SINTEF are commercializing cryogenic suspension technologies and advanced acoustic shielding, targeting compact resonator platforms suitable for urban deployment and satellite-based observatories.

The competitive dynamics are further shaped by large-scale projects such as the European Einstein Telescope and upgrades to the LIGO and Virgo facilities, which have accelerated demand for custom resonators with extreme sensitivity and stability. Suppliers like American Superconductor Corporation are entering the market with high-purity superconducting materials for resonator components, promising lower energy loss and improved signal fidelity.

- Incumbents are leveraging decades of precision optics manufacturing to defend market share through vertical integration and R&D partnerships with major observatories.

- New market entrants are focusing on agility, collaborating directly with academic groups to prototype resonators optimized for niche detection scenarios, such as mid-frequency gravitational waves.

- The sector as a whole is experiencing increased standardization in component interfaces, enabling interoperability and lowering barriers for new suppliers.

Looking ahead to the next few years, the gravitational wave resonator manufacturing market is expected to see further consolidation, with technology licensing and co-development agreements becoming commonplace. As the requirements for sensitivity and bandwidth become more demanding, competition will likely center on advanced materials, cryogenic integration, and rapid customization for diverse deployment environments.

Future Outlook: Investment Hotspots and Disruption Scenarios

The landscape of gravitational wave resonator manufacturing is poised for dynamic evolution through 2025 and the following few years, marked by both concentrated investment and disruptive technological advancements. Key players are ramping up their efforts to refine both the sensitivity and scalability of resonator components, driven by the needs of next-generation observatories and quantum sensing initiatives.

One major investment hotspot is the fabrication of ultra-high purity mirror substrates and coatings, essential for minimizing thermal noise and enhancing the detection capabilities of resonators. LIGO Laboratory has been collaborating with specialized optics manufacturers to develop advanced crystalline coatings, which are projected to reduce mechanical losses by an order of magnitude. This aligns with broader efforts by European Gravitational Observatory (Virgo) to source ultra-low absorption materials, supporting upgrades planned through 2027.

Another focal area is the precision engineering of suspension systems and seismic isolation platforms. Gooch & Housego, a supplier of photonic and precision engineering solutions, is investing in automated fabrication lines to meet rising demand for high-stability resonator components. These advances are critical for the Einstein Telescope and Cosmic Explorer projects, both of which are entering the design and prototyping phase and will require large-scale procurement between 2025 and 2028.

On the disruption front, quantum-enhanced measurement technologies are poised to reshape the market. National Institute of Standards and Technology (NIST) is piloting new resonator geometries and quantum noise reduction schemes, with the potential to halve the required resonator mass, enabling compact detector arrays and distributed gravitational wave networks. Such breakthroughs could attract new classes of investors and hardware integrators, shifting the competitive dynamics in favor of agile, innovation-driven suppliers.

Supply chain robustness is also a growing concern, especially for rare-earth-doped crystals and advanced piezoelectric materials. To mitigate risks linked to geopolitical tensions or raw material shortages, manufacturers like Thorlabs are expanding vertical integration and building regional production hubs in North America and Europe.

Looking ahead, the gravitational wave resonator manufacturing sector will likely see intensified collaboration between research consortia, component suppliers, and automation firms. The next two to five years will be pivotal, as large-scale observatory projects move from design to procurement, creating significant opportunities for capital investment and disruptive innovation.

Sources & References

- Thorlabs, Inc.

- LIGO Laboratory

- Virgo Collaboration

- Einstein Telescope Collaboration

- Virgo Collaboration

- European Gravitational Observatory (EGO)

- Leybold

- Edwards Vacuum

- KAGRA (Institute for Cosmic Ray Research, University of Tokyo)

- Shin-Etsu Chemical

- Nippon Steel Corporation

- Laser Zentrum Hannover

- Heraeus

- Laseroptik

- Institute of Electrical and Electronics Engineers (IEEE)

- American Society of Mechanical Engineers (ASME)

- National Institute of Standards and Technology (NIST)

- ESI Group

- Lockheed Martin

- Northrop Grumman

- Gentec-EO

- SINTEF

- American Superconductor Corporation

- Thorlabs